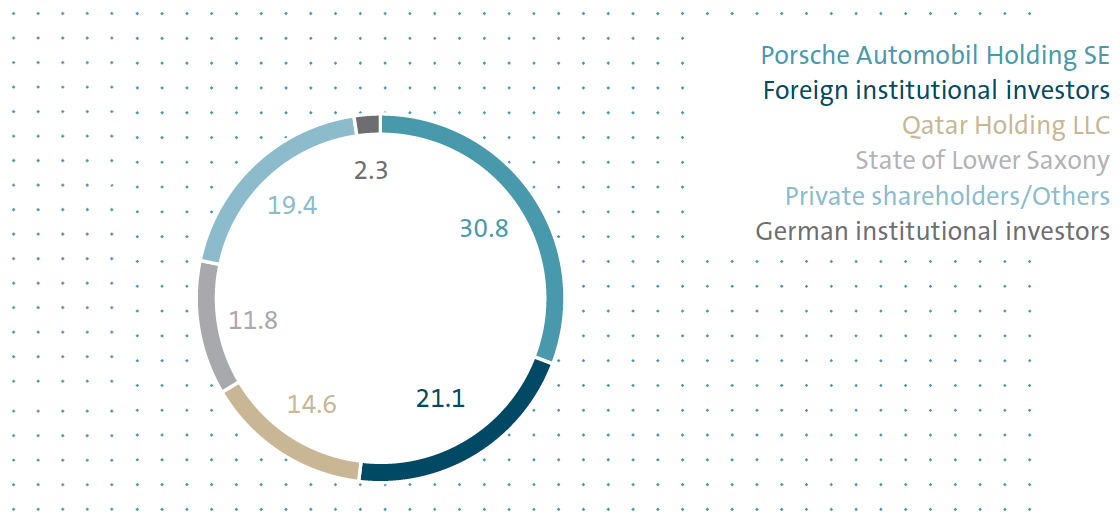

Shareholder structure

SHAREHOLDER STRUCTURE AT DECEMBER 31, 2015

as a percentage of subscribed capital

SHAREHOLDER STRUCTURE AS OF DECEMBER 31, 2015

Volkswagen AG’s subscribed capital amounted to €1,283,315,873.28 at the end of the reporting period. The shareholder structure of Volkswagen AG as of December 31, 2015 is shown in the chart on this page.

The distribution of voting rights for the 295,089,818 ordinary shares was as follows at the reporting date: Porsche Automobil Holding SE, Stuttgart, held 52.2% of the voting rights. The second-largest shareholder was the State of Lower Saxony, which held 20.0% of the voting rights. Qatar Holding LLC was the third-largest shareholder, with 17.0%. The remaining 10.8% of ordinary shares were attributable to other shareholders.

Notifications of changes in voting rights in accordance with the Wertpapierhandelsgesetz (WpHG – German Securities Trading Act) are published on our website at www.volkswagenag.com/ir.

SUCCESSFUL HYBRID NOTE PLACEMENT AND MANDATORY CONVERTIBLE NOTE SETTLEMENT

In March 2015, the Volkswagen Group successfully placed dual-tranche hybrid notes with an aggregate principal amount of €2.5 million via Volkswagen International Finance N.V. Both tranches are perpetual and increase the Group’s equity by 100%, net of transaction costs.

In 2012 and 2013, we placed two mandatory convertible notes with identical features entitling holders to subscribe for Volkswagen preferred shares totaling €3.7 billion. Mandatory conversion took place for the holders of the notes on the final maturity date (November 9, 2015). A total of 25.6 million new preferred shares were created during the term.

ANNUAL GENERAL MEETING

The 55th Annual General Meeting of Volkswagen AG was held at the Hanover Exhibition Center on May 5, 2015. With 91.93% of the voting capital present, the ordinary shareholders of Volkswagen AG formally approved the actions of the Board of Management and the Supervisory Board and the conclusion of an intercompany agreement. They also elected PricewaterhouseCoopers AG Wirtschaftsprüfungsgesellschaft as the auditors for the single-entity and consolidated financial statements for fiscal year 2015 and as the auditors to review the condensed consolidated financial statements and interim management report for the first six months of 2015.

Mr. Hussain Ali Al-Abdulla’s scheduled term of office on the Supervisory Board of Volkswagen AG expired at the end of the Annual General Meeting. The Annual General Meeting elected Mr. Al-Abdulla to the Supervisory Board for a further full term of office as a shareholder representative. Mr. Ahmad Al-Sayed, likewise a shareholder representative on the Supervisory Board of Volkswagen AG, stepped down from his post as of the end of the Annual General Meeting. The Annual General Meeting elected Mr. Akbar Al Baker, Minister of State and Group Chief Executive of Qatar Airways, to replace him for the remainder of his term of office. In addition, the ordinary shareholders authorized the Board of Management to issue a total of up to 70 million new non-voting preferred bearer shares within the next five years.

The Annual General Meeting also resolved to distribute a dividend of €4.80 per ordinary share and €4.86 per preferred share for fiscal year 2014.