Volkswagen Group deliveries

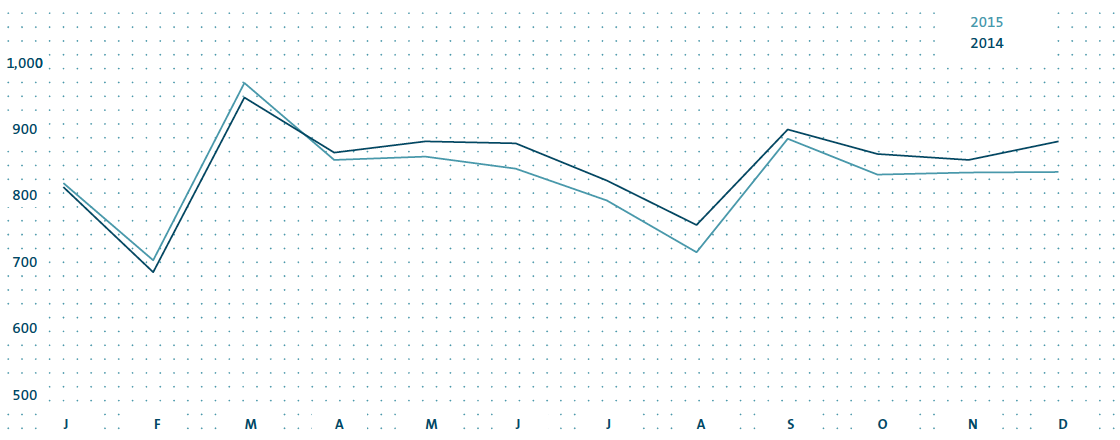

In 2015, the Volkswagen Group handed over 9,930,517 vehicles to customers worldwide, down slightly (2.0%) on the prior-year figure. The chart on this page shows how deliveries changed from month to month and compares each monthly figure to the same month of the previous year. Details of deliveries of passenger cars and commercial vehicles are provided separately in the following.

| (XLS:) |

VOLKSWAGEN GROUP DELIVERIES* |

||||||||

|---|---|---|---|---|---|---|---|---|

|

2015 |

2014 |

% |

|||||

|

|

|

|

|||||

|

||||||||

Passenger cars |

9,320,681 |

9,490,958 |

−1.8 |

|||||

Commercial vehicles |

609,836 |

646,486 |

−5.7 |

|||||

Total |

9,930,517 |

10,137,444 |

−2.0 |

|||||

VOLKSWAGEN GROUP DELIVERIES BY MONTH

Vehicles in thousands

PASSENGER CAR DELIVERIES WORLDWIDE

With its brands, the Volkswagen Group has a presence in all relevant automotive markets around the world. Western Europe, China, the USA, Brazil and Mexico are currently the key sales markets for the Group. Thanks to our wide range of attractive and efficient vehicles, we have a strong position amid persistently challenging competition.

Under increasingly difficult conditions in relevant markets, such as Brazil, China and Russia, deliveries of passenger cars to customers amounted to 9,320,681 units in the reporting period, 1.8% fewer than in the previous year. The passenger car market as a whole expanded by 2.6% in 2015, which meant that the Volkswagen Group’s share of the global market declined to 12.3 (12.9)%. The Volkswagen Group achieved the highest growth in absolute terms in Germany. Our sales figures in Brazil, China and Russia were impacted significantly by low demand. In the fourth quarter of 2015, the emissions issue affected the individual markets in Western Europe and in the USA and Canada in different ways, depending on the brand and market. The Audi (+3.6%), ŠKODA (+1.8%), Porsche (+18.6%) and Lamborghini (+28.3%) brands increased their delivery figures year-on-year, setting new records. SEAT also recorded growth of 2.4% on the prior-year figure.

The table below gives an overview of deliveries to customers of the Volkswagen Group in the key individual markets and regions. The demand trends for Group models in these markets and regions are described in the following sections.

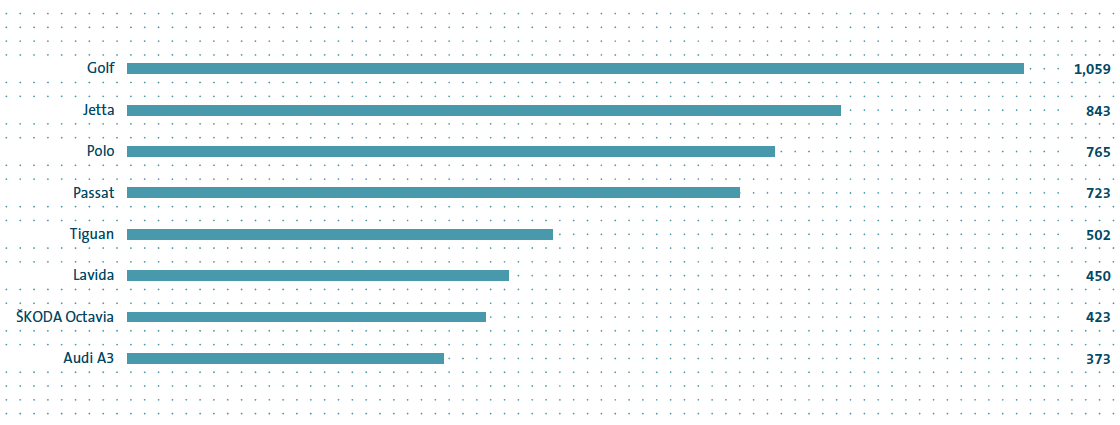

WORLDWIDE DELIVERIES OF THE GROUP'S MOST SUCCESSFUL MODELS IN 2015

Vehicles in thousands

Deliveries in Europe/Other markets

The recovery of Western Europe’s passenger car market as a whole continued in 2015, with growth of 9.0%. The Volkswagen Group’s deliveries to customers increased by 5.1% to 3,062,368 units in this region. Demand for Group models was up year-on-year in all major markets in this region. The Golf Sportsvan, Passat and ŠKODA Fabia models recorded the highest growth rates. In addition, demand for the Polo, Golf, Tiguan, Audi A3, Audi TT, ŠKODA Octavia and Porsche Macan models was particularly strong. The new Touran, Audi A4, Audi Q7 and ŠKODA Superb models were successfully launched on the market. The Group’s share of the passenger car market in Western Europe was 24.4 (25.1)%.

In Central and Eastern Europe, we handed over −7.7% fewer passenger cars to customers in 2015 than in the year before. This region’s market as a whole contracted by 23.3% in the same period. The Group’s sales figures in Russia and Ukraine declined massively as a result of the difficult economic and political situation in the two countries. In the Czech Republic, Poland, Hungary and Romania, meanwhile, we recorded strong growth in some cases. The Golf Sportsvan, Audi Q7, ŠKODA Fabia Combi and SEAT Leon ST models recorded the highest growth rates. The Group’s share of the passenger car market in Central and Eastern Europe increased to 20.3 (16.9)%.

In the South African passenger car market, which is still on the decline, the number of Volkswagen Group vehicles delivered to customers in 2015 was down 9.4% on the previous year. The up!, Polo, Golf and Audi A4 saloon models recorded strong demand.

Demand for Group vehicles in the Middle East region grew by 18.7% compared with the previous year. The Polo, Golf, Jetta, Passat and ŠKODA Octavia models were particularly popular.

Deliveries in Germany

The German passenger car market continued to recover in 2015, expanding by 5.6%. The Volkswagen Group’s performance in its home market was similarly positive; sales to customers increased by 5.0% year-on-year to 1,147,484 units. The highest growth rates were achieved by the Passat, Audi TT, Audi Q7, ŠKODA Fabia Combi and ŠKODA Superb saloon models. The Polo, Golf, Golf Sportsvan, Audi A4 and Porsche Macan models also enjoyed great popularity. At the end of 2015, eight Volkswagen Group models led the Kraftfahrt-Bundesamt (KBA – German Federal Motor Transport Authority) registration statistics in their respective segments: up!, Polo, Golf, Tiguan, Touran, Passat, Audi TT and Audi A6. The Golf remained the most popular passenger car in Germany in terms of registrations.

Deliveries in North America

In North America, the Volkswagen Group benefited from the market’s positive overall performance; it sold 922,774 vehicles in the reporting period, 4.3% more than in the previous year. The Group’s share of the passenger car market amounted to 4.5 (4.6)%. The Jetta was the Group’s best-selling model in North America.

In the US market, demand for Group models rose slightly in 2015, increasing by 1.2% year-on-year. The market as a whole increased by 5.7% in the same period. Models in the SUV and pickup segments remained in particularly high demand. Demand for the Golf, Tiguan, Audi A3, Audi Q3, Audi Q5 and Porsche Macan models recorded positive growth.

In the Canadian market, which saw slight growth, we delivered 8.8% more vehicles to customers in the reporting period than in the previous year. The Jetta remained the most sought-after Group model, while the Golf, Tiguan, Audi Q3 and Audi Q5 also recorded encouraging demand.

In the fast-growing Mexican market, the Group’s sales were up 11.9% year-on-year. The Vento and Jetta were especially popular.

Deliveries in South America

Conditions in the highly competitive South American markets were again very challenging in fiscal year 2015. In the generally sharply declining markets in this region, sales amounted to 489,636 units; this represents a decrease of 29.0% in demand for Group models compared with the previous year. The Volkswagen Group’s share of the passenger car market in this region declined to 15.7 (17.4)%.

In the Brazilian passenger car market, which has suffered massive declines, the Volkswagen Group delivered 36.3% fewer vehicles than in the year before. The best-selling models were the up!, Fox, Gol, Saveiro and Audi A3.

In Argentina, the downward trend of the market as a whole slowed in the course of 2015. Demand for Volkswagen Group models increased by 2.8% year-on-year in the same period. The Gol continued to be the most popular Group model in Argentina in terms of registrations.

Deliveries in the Asia-Pacific region

The passenger car markets in the Asia-Pacific region expanded by 4.0% in 2015, with declining momentum overall. The Volkswagen Group handed over 3,902,169 vehicles to customers there, 3.0% fewer than in the previous year.

China, the world’s largest single market, was again the growth driver of the Asia-Pacific region in 2015, recording the highest absolute increase. Attractively priced entry-level models in the SUV segment remained highly sought after. Volkswagen delivered 3.4% fewer vehicles to customers in China than in the prior-year period. The Jetta, Lavida, Sagitar, Tiguan, Audi Q5, ŠKODA Octavia saloon and Porsche Macan were popular models. The Lamando was successfully launched in the market.

In the growing Indian passenger car market, our sales declined by 1.9% year-on-year. The Polo remained the most popular Group vehicle, and there was also strong demand for the Audi A3, ŠKODA Rapid and ŠKODA Octavia saloon models.

In the Japanese passenger car market, demand for Group vehicles was down 12.5% year-on-year in the reporting period. The market as a whole contracted by 10.2% in the same period. Even so, the Passat, Audi Q3 and Porsche Macan models recorded increases.

| (XLS:) |

PASSENGER CAR DELIVERIES TO CUSTOMERS BY MARKET* |

||||||||

|---|---|---|---|---|---|---|---|---|

|

DELIVERIES (UNITS) |

CHANGE |

||||||

|

2015 |

2014 |

(%) |

|||||

|

|

|

|

|||||

|

||||||||

Europe/Other markets |

4,006,102 |

3,893,777 |

+2.9 |

|||||

Western Europe |

3,062,368 |

2,912,905 |

+5.1 |

|||||

of which: Germany |

1,147,484 |

1,092,675 |

+5.0 |

|||||

United Kingdom |

521,345 |

510,481 |

+2.1 |

|||||

France |

252,530 |

249,311 |

+1.3 |

|||||

Spain |

235,139 |

203,870 |

+15.3 |

|||||

Italy |

207,821 |

190,671 |

+9.0 |

|||||

Central and Eastern Europe |

559,945 |

606,852 |

−7.7 |

|||||

of which: Russia |

164,653 |

253,176 |

−35.0 |

|||||

Czech Republic |

126,886 |

100,967 |

+25.7 |

|||||

Poland |

104,772 |

95,790 |

+9.4 |

|||||

Other markets |

383,789 |

374,020 |

+2.6 |

|||||

of which: Turkey |

164,787 |

128,592 |

+28.1 |

|||||

South Africa |

90,659 |

100,058 |

−9.4 |

|||||

North America |

922,774 |

884,454 |

+4.3 |

|||||

of which: USA |

607,096 |

599,734 |

+1.2 |

|||||

Mexico |

211,845 |

189,328 |

+11.9 |

|||||

Canada |

103,833 |

95,392 |

+8.8 |

|||||

South America |

489,636 |

690,101 |

−29.0 |

|||||

of which: Brazil |

353,508 |

554,828 |

−36.3 |

|||||

Argentina |

97,775 |

95,086 |

+2.8 |

|||||

Asia-Pacific |

3,902,169 |

4,022,626 |

−3.0 |

|||||

of which: China |

3,542,467 |

3,668,433 |

−3.4 |

|||||

Japan |

91,152 |

104,218 |

−12.5 |

|||||

India |

69,323 |

70,656 |

−1.9 |

|||||

Worldwide |

9,320,681 |

9,490,958 |

−1.8 |

|||||

Volkswagen Passenger Cars |

5,823,408 |

6,118,654 |

−4.8 |

|||||

Audi |

1,803,246 |

1,741,129 |

+3.6 |

|||||

ŠKODA |

1,055,501 |

1,037,226 |

+1.8 |

|||||

SEAT |

400,037 |

390,505 |

+2.4 |

|||||

Bentley |

10,100 |

11,020 |

−8.3 |

|||||

Lamborghini |

3,245 |

2,530 |

+28.3 |

|||||

Porsche |

225,121 |

189,849 |

+18.6 |

|||||

Bugatti |

23 |

45 |

−48.9 |

|||||

COMMERCIAL VEHICLE DELIVERIES

The Volkswagen Group delivered a total of 609,836 commercial vehicles to customers worldwide in the reporting period, 5.7% fewer than in the previous year. Trucks accounted for 161,901 units (−9.9%), and buses accounted for 17,134 units (−15.5%). Sales by the Volkswagen Commercial Vehicles brand were down 3.5% on the prior-year figure, with 430,801 vehicles delivered in 2015. The MAN brand handed over 102,474 vehicles to customers, 14.7% fewer than in 2014, while the Scania brand’s deliveries were down 4.0% year-on-year at 76,561.

With the economy in Western Europe picking up, the Volkswagen Group delivered 2.0% more commercial vehicles than in the previous year, a total of 368,603 units; of this figure, 284,600 were light commercial vehicles, 79,146 were trucks and 4,857 were buses. The Transporter and Caddy models were the most sought-after models in Western European markets.

In 2015, we handed over a total of 55,295 commercial vehicles to customers (−13.7%) in Central and Eastern Europe, consisting of 31,183 light commercial vehicles, 23,243 trucks and 869 buses. In Russia, the region’s largest market, deliveries to customers declined by 56.9% to a total of 9,736 units due to the tense and uncertain political situation, the economic downturn, the low oil price, the sustained currency weakness and difficult financing conditions in the reporting period. The Transporter and the Caddy were the Group models that experienced the highest demand in this region.

In the Other markets, the Volkswagen Group increased its deliveries by 2.8% to 74,935 commercial vehicles; of this figure, 49,840 were light commercial vehicles, 22,504 were trucks and 2,591 were buses.

In North America, the Group handed over 9,099 vehicles to customers in the reporting period, an increase of 9.2% year-on-year; of this figure, 6,802 were light commercial vehicles, 474 were trucks and 1,823 were buses.

Deliveries in the South American markets declined overall to 68,958 units (−34.2%), consisting of 36,961 light commercial vehicles, 27,311 trucks and 4,686 buses. The economic slowdown and difficult financing conditions in Brazil led to a 51.3% decrease in deliveries to customers; 12,218 light commercial vehicles, 21,327 trucks and 2,968 buses were handed over to customers. Once again, the Amarok was particularly popular in Brazil.

In the Asia-Pacific region, the Volkswagen Group handed over 32,946 vehicles to customers in the reporting period; 21,415 light commercial vehicles, 9,223 trucks and 2,308 buses: a total of 6.1% less than in the previous year. The Amarok and the Transporter were the most popular Group models. In the Chinese market, the Group delivered 6,165 units to customers; of this figure, 3,860 were light commercial vehicles, 2,068 were trucks and 237 were buses. Overall, this represents a decrease of 10.5% on the prior-year figure.

| (XLS:) |

COMMERCIAL VEHICLE DELIVERIES TO CUSTOMERS BY MARKET* |

||||||||

|---|---|---|---|---|---|---|---|---|

|

DELIVERIES (UNITS) |

CHANGE |

||||||

|

2015 |

2014 |

(%) |

|||||

|

|

|

|

|||||

|

||||||||

Europe/Other markets |

498,833 |

498,345 |

+0.1 |

|||||

Western Europe |

368,603 |

361,372 |

+2.0 |

|||||

Central and Eastern Europe |

55,295 |

64,052 |

−13.7 |

|||||

Other markets |

74,935 |

72,921 |

+2.8 |

|||||

North America |

9,099 |

8,331 |

+9.2 |

|||||

South America |

68,958 |

104,728 |

−34.2 |

|||||

of which: Brazil |

36,513 |

74,977 |

−51.3 |

|||||

Asia-Pacific |

32,946 |

35,082 |

−6.1 |

|||||

of which: China |

6,165 |

6,887 |

−10.5 |

|||||

Worldwide |

609,836 |

646,486 |

−5.7 |

|||||

Volkswagen Commercial Vehicles |

430,801 |

446,616 |

−3.5 |

|||||

Scania |

76,561 |

79,782 |

−4.0 |

|||||

MAN |

102,474 |

120,088 |

−14.7 |

|||||

DELIVERIES IN THE POWER ENGINEERING SEGMENT

Orders in the Power Engineering segment are usually part of major investment projects. Lead times typically range from just under one year to several years, and partial deliveries as construction progresses are common. Accordingly, there is a time lag between incoming orders and sales revenue from the new construction business.

Sales revenue in the Power Engineering segment was largely driven by Engines & Marine Systems and Turbomachinery, which together generated three-quarters of the overall revenue volume. In 2015, the world’s first compressor for an underwater gas production facility was put into operation.