Refinancing

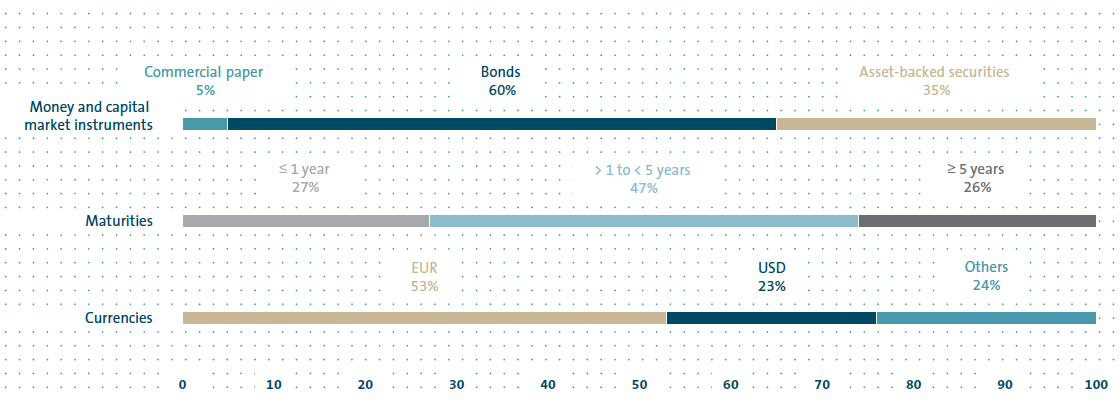

REFINANCING STRUCTURE OF THE VOLKSWAGEN GROUP

as of December 31, 2015

In the refinancing activities conducted in 2015, the Volkswagen Group continued to attach great importance to instrument and market diversification. The main currencies of its prime-rated and unsecured issues were euros, US dollars, sterling and Canadian dollars; the share of fixed-rate instruments was roughly twice as high as the share of variable-rate instruments.

The need for financing was reduced as a result of the generally positive development of net liquidity in fiscal year 2015. In addition to the operating business, the sale of the shares in Suzuki was a contributing factor.

Moreover, net liquidity was boosted in March 2015 by placing unsecured subordinated hybrid notes with an aggregate principal amount of €2.5 billion. The perpetual notes were issued in two tranches and can only be called by the issuer. The first call date for the first tranche with a volume of €1.1 billion is after seven years, and the first call date for the second tranche of €1.4 billion is after 15 years.

In the European region, a benchmark bond with a value of €3.0 billion was successfully issued for the Automotive Division. We also acted in this market for the Financial Services Division, issuing two benchmark bonds with a total value of €2.75 billion and raising another €7.7 billion through ABS (asset-backed securities) transactions. The financing mix was complemented by private placements, making use of available interest rate and currency opportunities.

The Volkswagen Group was also active again in the North American capital market and was able to exploit the favorable pricing situation to its advantage. A four-tranche issue with an aggregate volume of USD 2.8 billion was placed and another USD 3.8 billion was securitized in ABS transactions. In the Canadian refinancing market, we issued bonds with a value of CAD 900 million in an attractive market environment.

The Volkswagen Group placed other securities in the ABS segment in Australia, Brazil, China, the United Kingdom, Japan and Canada.

In all refinancing arrangements, interest rate and currency risk is generally excluded by entering into derivatives contracts at the same time.

The table below shows how our money and capital market programs were utilized as of December 31, 2015 and illustrates the financial flexibility of the Volkswagen Group:

| (XLS:) |

|

|

|

||

PROGRAM |

Authorized volume |

Amount utilized on Dec. 31, 2015 |

||

|---|---|---|---|---|

|

|

|

||

Commercial paper |

26.1 |

4.8 |

||

Bonds |

126.8 |

61.3 |

||

of which hybrid issues |

|

7.5 |

||

Asset-backed securities |

53.1 |

29.4 |

The ability to access individual refinancing instruments in the money and capital market was limited due to the current uncertainties regarding the effects of the emissions issue on the Volkswagen Group.

In December 2015, a consortium of banks granted Volkswagen AG an additional syndicated credit line amounting to €20 billion with a maturity of one year. After exercising an extension option in the reporting period, the syndicated credit line of €5.0 billion agreed in July 2011 was extended to April 2020. The credit line remains unused.

Syndicated credit lines worth a total of €3.1 billion at other Group companies have also not been drawn down. In addition, Group companies had arranged bilateral, confirmed credit lines with national and international banks in various other countries for a total of €7.3 billion, of which €2.6 billion was drawn down.