Financial Positions

Financial position of the Group

The Volkswagen Group generated gross cash flow of €16.3 billion in fiscal year 2015, representing a 38.7% decline year-on-year. Funds tied up in working capital amounted to €2.6 billion, down €13.2 billion on the previous year. The special items had a negative impact on gross cash flow and a positive effect on the change in working capital. Cash flows from operating activities were up by €2.9 billion year-on-year and amounted to €13.7 billion.

At €15.5 (16.5) billion, the Volkswagen Group’s investing activities attributable to operating activities were down year-on-year, mainly due to the sale of the Suzuki shares. Within this item, investments in property, plant and equipment, investment property and intangible assets, excluding capitalized development costs (capex) increased from €12.0 billion to €13.2 billion, and capitalized development costs also rose by €0.4 billion to €5.0 billion. Net cash flow amounted to €−1.8 (5.7) billion.

Cash inflows from financing activities amounted to €9.1 (4.6) billion. This figure includes the dual-tranche hybrid notes successfully placed in March 2015, which was largely offset by dividend payments. In the previous year, the figure included the increase in the interest in Scania, a capital increase and the issuance of hybrid notes.

The Group’s net liquidity amounted to €−100.5 billion on December 31, 2015, compared with €−96.5 billion as of year-end 2014.

AUTOMOTIVE DIVISION NET CASH FLOW

€ billion

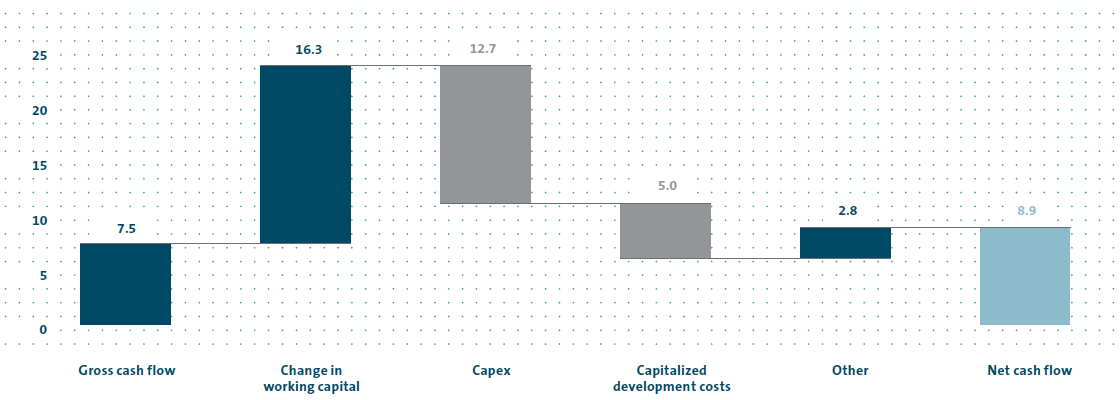

Financial position in the Automotive Division

In fiscal year 2015, the Automotive Division generated gross cash flow of €7.5 billion; the decline of €12.6 billion compared with the 2014 figure was primarily due to the special items, which were partly offset by the positive change in the quality of earnings and higher dividend payments by the Chinese joint ventures. The change in working capital of €16.3 (1.4) billion resulted primarily from the impact of the special items, which have not yet been reflected in cash flow. Cash flows from operating activities increased by €2.2 billion to €23.8 billion.

At €14.9 (15.5) billion, investing activities attributable to operating activities in the year under review were down year-on-year. Capex rose to €12.7 (11.5) billion, producing a capex ratio of 6.9 (6.5)%. We invested mainly in our production facilities and in models that we launched in 2015 or are planning to launch in 2016. These are primarily vehicles in the Tiguan, Passat, Touran, Audi A4, Audi Q7, Audi Q5 and Audi A8 series, as well as the Porsche Panamera and the Bentley Bentayga. Other investment priorities were the ecological focus of our model range, the growing use of electric drives and our modular toolkits. Capitalized development costs rose to €5.0 (4.6) billion. Investing activities in 2015 included a cash inflow of €3.1 billion from the sale of the Suzuki shares. The prior-year figure included the intragroup sale of MAN Finance International GmbH.

The Automotive Division’s net cash flow improved by €2.8 billion to €8.9 billion.

In financing activities, the capital increases carried out by Volkswagen AG at Volkswagen Financial Services AG in fiscal year 2015 in order to finance the growth in business volumes and comply with the increase in regulatory capital requirements resulted in outflows of €2.3 billion. In May, a total dividend of €2.3 billion, €0.4 billion higher than in the previous year, was distributed to Volkswagen AG shareholders. Conversely, the successful placement of dual-tranche hybrid notes with an aggregate principal amount of €2.5 billion via Volkswagen International Finance N.V. in March resulted in a cash inflow. These consist of a €1.1 billion note that carries a coupon of 2.5% and has a first call date after seven years, and a €1.4 billion note that carries a coupon of 3.5% and has a first call date after 15 years. Both tranches are perpetual and increase equity by the full amount, net of transaction costs, among other things. €2.5 billion of the hybrid notes was classified as a capital contribution, which increased net liquidity. The Automotive Division’s financing activities also include the issuance and redemption of bonds and other financial liabilities in the total amount of €−6.3 (−7.9) billion. In the previous year, the figure included the acquisition of Scania shares, a capital increase and the issuance of hybrid notes.

The Automotive Division recorded net liquidity of €24.5 billion as of December 31, 2015; at year-end 2014, it was €17.6 billion.

| (XLS:) |

FINANCIAL POSITION IN THE PASSENGER CARS BUSINESS AREA |

||||

|---|---|---|---|---|

€ million |

2015 |

2014 |

||

|

|

|

||

Gross cash flow |

4,722 |

17,965 |

||

Change in working capital |

15,469 |

2,682 |

||

Cash flows from operating activities |

20,191 |

20,647 |

||

Cash flows from investing activities attributable to operating activities |

−12,434 |

−13,942 |

||

Net cash flow |

7,757 |

6,705 |

||

Gross cash flow in the Passenger Cars Business Area amounted to €4.7 billion in fiscal year 2015, 73.7% lower than in the previous year. The decrease was primarily attributable to the special items, which at the same time had a positive effect on working capital. At €15.5 (2.7) billion, this increased as against the previous year. Cash flows from operating activities decreased by 2.2% to €20.2 billion. At €12.4 (13.9) billion, investing activities attributable to operating activities were down year-on-year, largely due to the sale of the Suzuki shares. Capex and capitalized development costs rose to €10.9 (10.1) billion and €4.2 (4.0) billion, respectively. Net cash flow increased by €1.1 billion to €7.8 billion.

| (XLS:) |

FINANCIAL POSITION IN THE COMMERCIAL VEHICLES/ POWER ENGINEERING BUSINESS AREA |

||||

|---|---|---|---|---|

€ million |

2015 |

2014 |

||

|

|

|

||

Gross cash flow |

2,795 |

2,201 |

||

Change in working capital |

810 |

−1,255 |

||

Cash flows from operating activities |

3,605 |

946 |

||

Cash flows from investing activities attributable to operating activities |

−2,475 |

−1,534 |

||

Net cash flow |

1,129 |

−588 |

||

The Commercial Vehicles/Power Engineering Business Area generated gross cash flow of €2.8 billion in the reporting period, up €0.6 billion on the previous year despite the special items from restructuring expenses. €0.8 billion was released from working capital in the reporting period, after funds of €1.3 billion were tied up in the previous year. As a result, cash flows from operating activities rose to €3.6 (0.9) billion. Investing activities attributable to operating activities increased year-on-year to €2.5 (1.5) billion. The increase was due in particular to capital expenditures on the new plant in Wrzesnia, Poland, and on the successor to the Volkswagen Crafter that will be built there in the future. Net cash flow rose by €1.7 billion to €1.1 billion in the reporting period.

Financial position in the Financial Services Division

The Financial Services Division’s gross cash flow rose by 37.3% year-on-year to €8.8 billion in the fiscal year due to an improvement in earnings quality. Funds tied up in working capital increased by €1.7 billion to €18.9 billion as a result of higher volumes. At €0.6 (1.0) billion, investing activities attributable to operating activities were significantly lower than in the previous year, when the figure reflected the intragroup acquisition of MAN Finance International GmbH. Volkswagen AG contributed a capital increase of €2.3 billion to the Financial Services Division’s financing activities to finance the expected growth in business in existing and new markets as well as to comply with the continued increase in regulatory requirements. Cash inflows to financing activities amounted to €15.4 (12.6) billion overall.

The Financial Services Division’s negative net liquidity, which is common in the industry, amounted to €−125.1 billion at the end of the reporting period, compared with €−114.1 billion on December 31, 2014.